Hi!

I try to calculate IRR for a bond with

start date: 2022-01-03

maturity date: 2025-01-03

settlement date: 2022-11-04

coupon: 2% (annual)

frequency: semiannual (Frequency.P6M)

day count: act/365 (DayCounts.ACT_365L)

clean price: 97

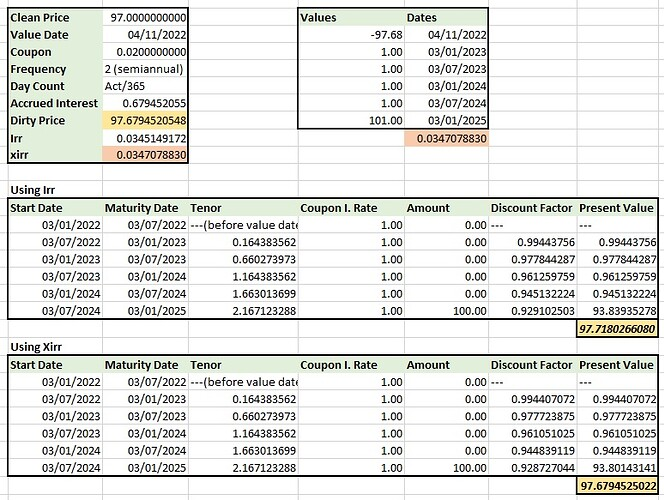

Using yieldFromDirtyPrice, I’ve a irr of 0.0345149172.

Using MS XIRR I’ve a irr of 0.0347078830.

Discounting cashflow with MS XIRR I got, exactly, the dirty price (97.6794520548),

Using strata irr I got 97.7180266080.

this is my code

public static void test() {

LocalDate settlementDate = LocalDate.of(2022,11, 4);

LocalDate startDate = LocalDate.of(2022,1, 3);

LocalDate maturityDate = LocalDate.of(2025,1, 3);

double couponRate = 0.02;

BusinessDayAdjustment businessDayAdj = BusinessDayAdjustment.of(

BusinessDayConventions.NO_ADJUST, HolidayCalendarIds.NO_HOLIDAYS);

PeriodicSchedule accrualSchedule = PeriodicSchedule

.builder()

.startDate(startDate)

.endDate(maturityDate)

.lastRegularEndDate(maturityDate)

.businessDayAdjustment(businessDayAdj)

.frequency(Frequency.P6M)

.stubConvention(StubConvention.NONE)

.rollConvention(RollConventions.EOM)

.build();

FixedCouponBond fcb = FixedCouponBond

.builder()

.accrualSchedule(accrualSchedule)

.currency(Currency.EUR)

.securityId(SecurityId.of("CUSIP", "135087WL4"))

.notional(100.)

.fixedRate(couponRate)

.dayCount(DayCounts.ACT_365L)

.yieldConvention(FixedCouponBondYieldConvention.DE_BONDS)

.legalEntityId(LegalEntityId.of("LegalEntity", "DUMMY"))

.settlementDateOffset(DaysAdjustment.ofBusinessDays(3, HolidayCalendarIds.CATO))

.build();

ResolvedFixedCouponBond resolvedBond = fcb.resolve(ReferenceData.standard());

double cleanPrice = 97 / 100.;

double dirtyPrice = DiscountingFixedCouponBondProductPricer.DEFAULT.dirtyPriceFromCleanPrice(resolvedBond, settlementDate,cleanPrice);

double accrual = DiscountingFixedCouponBondProductPricer.DEFAULT.accruedInterest(resolvedBond, settlementDate);

double yield = DiscountingFixedCouponBondProductPricer.DEFAULT.yieldFromDirtyPrice(resolvedBond, settlementDate, dirtyPrice);

double calculatedDirty = DiscountingFixedCouponBondProductPricer.DEFAULT.dirtyPriceFromYield(resolvedBond, settlementDate, yield);

double macaulayDuration = DiscountingFixedCouponBondProductPricer.DEFAULT.macaulayDurationFromYield(resolvedBond, settlementDate, yield);

double modifiedDuration = DiscountingFixedCouponBondProductPricer.DEFAULT.modifiedDurationFromYield(resolvedBond, settlementDate, yield);

System.out.println("yield: " + yield);

System.out.println("dirty: " + dirtyPrice);

System.out.println("calculatedDirty: " + calculatedDirty);

System.out.println("macaulayDuration: " + macaulayDuration);

System.out.println("modifiedDuration: " + modifiedDuration);

System.out.println("accrual: " + accrual);

System.out.println("accrual days: " + DiscountingFixedCouponBondProductPricer.DEFAULT.accruedYearFraction(resolvedBond, settlementDate) * 365.);

}

What it’s wrong?